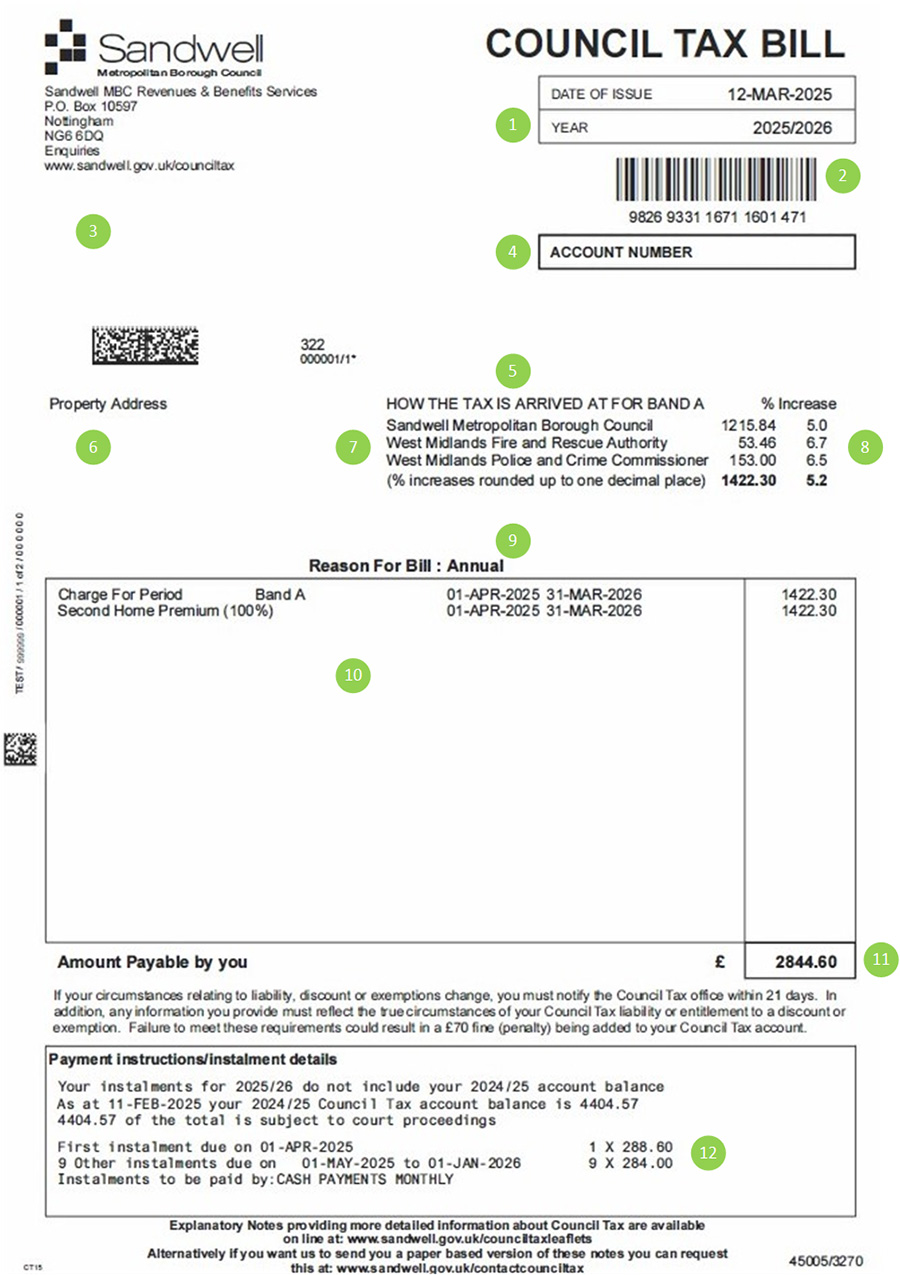

Your Council Tax Bill can be confusing. There is an example of a bill below and we have put a key underneath that answers some of the questions that we get asked a lot.

- This is the financial year that the bill relates to. The council’s financial year runs from April until March.

- The barcode is there so that our Cashiers team can scan it in when you make your payments with them. The barcode makes sure that your payment goes to the right account.

- Name and address of person or people responsible for paying the bill

- The Council Tax account number for the property. This will change when you move address. Please quote this number whenever you contact us about your Council Tax.

- The Valuation Office Agency decides which band your property is in and we charge Council Tax based on the amount that is set for your band. Please visit our Council Tax Banding page for more information.

- This is the address that the Council Tax shown on the bill is payable for.

- Your total bill is made up of an amount from Sandwell MBC and charges from other organisations that we collect on their behalf (known as precepts). In Sandwell we collect on behalf of West Midlands Fire and Rescue Authority, West Midlands Police and Crime Commissioner and Adult Social Care. The precepts are added to the amount from Sandwell MBC to make up your total council tax charge.

- The percentage increase from last year for each of the parts of your Council Tax. The bold percentage at the bottom is the increase in the total amount of Council Tax from last year. The Adult Social Care part of your bill is calculated differently from the rest of the bill, please see our page on the Adult Social Care precept for details.

- This is the reason that the bill has been sent out to you.

-

This details how your Council Tax charge is affected by any discounts that are applied to your account. Any figure with a minus in front of it is taken off your total charge and any figure without a minus is added on to your total charge.

Some of the most common things that will affect your bill are:

-

Single Person Discount – A 25% discount that you get for being the only person in the property eligible to pay Council Tax.

-

Council Tax Reduction – Any Council Tax Reduction (CTR) that you are entitled to will be used to reduce the amount that you pay.

-

Penalties and Court Costs – These will increase your bill by the amount shown.

-

Empty Property Discount – Please note that Sandwell no longer offer a discount for empty properties. The empty property code will still be shown on the bill but will not affect the amount that you have to pay.

- PREM1YR – This indicates that your property has been empty for more than one year. In this situation the Council Tax for the property increases by 100%.

-

PREM100 – This indicates that your property has been empty for more than two years. In this situation the Council Tax for the property increases by 100%.

-

PREM200 – This indicates that your property has been empty for more than five years. In this situation the Council Tax for the property increases by 200%.

-

PREM300 – This indicates that your property has been empty for more than ten years. In this situation the Council Tax for the property increases by 300%.

-

- This is the total amount that you need to pay. If the amount is followed by the letters CR, your account is in credit and you can contact us for a refund.

- The monthly payments that you need to make and the date that they need to be made by. If you pay by Direct Debit the amount shown will automatically be taken from your bank account on your chosen date. Any arrears or amounts outstanding from previous years are not included in these instalments and should be paid as previously arranged. You can make your payments online or set up a Direct Debit by going to our Council Tax payment page.