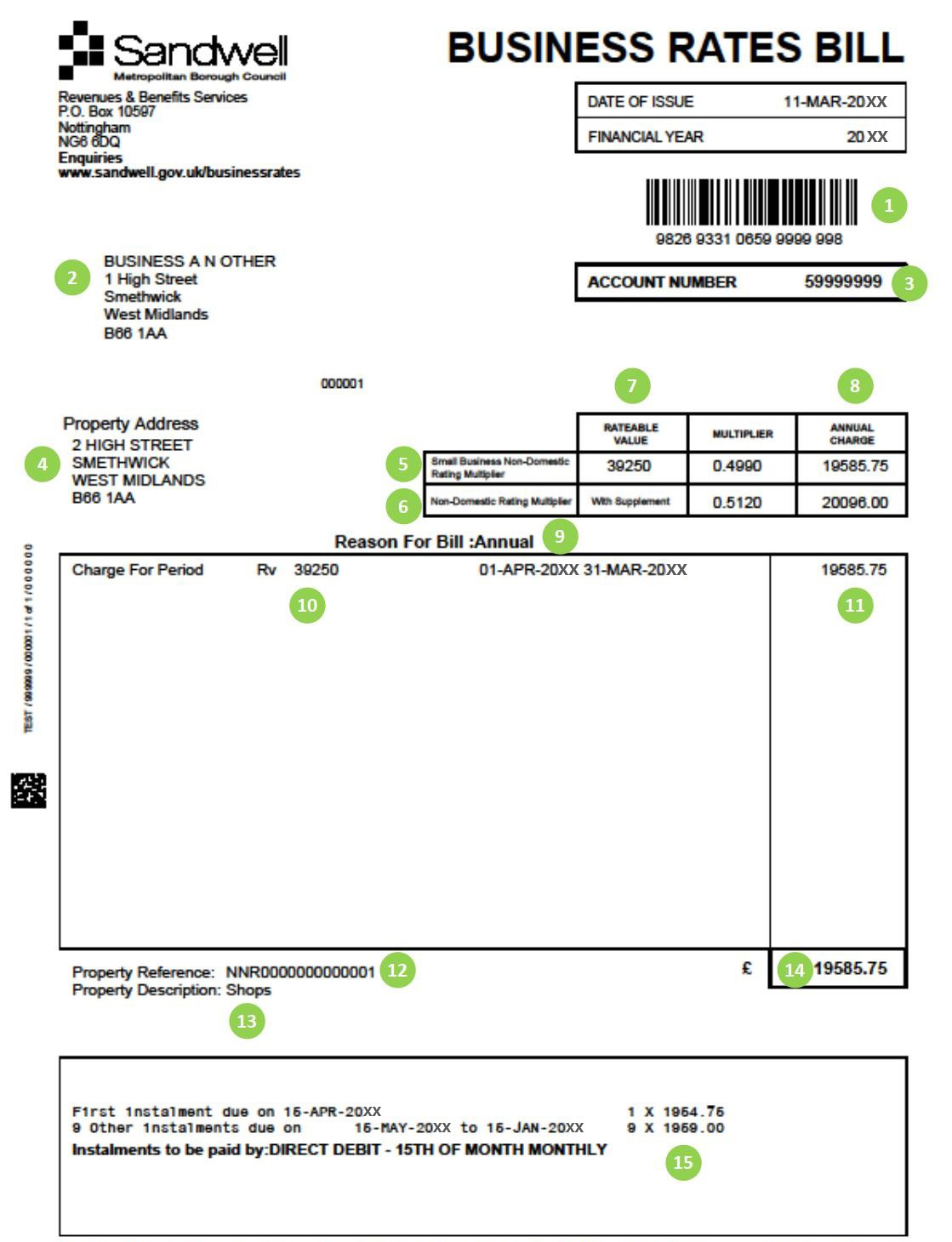

Your Business Rates bill can be confusing. There is an example of a bill below and we have put a key underneath that answers some of the questions that we get asked a lot.

- The barcode is used by our Cashier's service if you pay your bill with them. The barcode ensures that your payment goes to the correct account.

- Name and address of person or people responsible for paying the bill.

- The Business Rates account number for the property. This will change when you move address. Please quote this number whenever you contact us about your Business Rates.

- This is the address that the Business Rates shown on the bill are payable for.

- The Small Business Non-Domestic Rating Multiplier is applied to properties with a Rateable Value of less than £51,000.

- The Non-Domestic Rating Multiplier applies to properties with a Rateable Value of over £51,000 and includes an amount to fund the small business rate relief.

- The Rateable Value is the amount that the Valuation Office estimate that your property could reasonably be let for on an annual basis.

- Your annual charge is worked out by multiplying the Rateable Value for the property by the appropriate multiplier figure.

- This is the reason that the bill has been sent out to you.

- The Rateable Value that applies to this property.

- A breakdown of how your bill is made up.

- The reference number that we give to your property. The letters ‘NN’ indicate that it is a business premises. The rest of the number is the reference number as provided by the Valuation Office.

- This is the description of your property as shown on the Valuation Office Rating List.

- This is the total amount that you need to pay. If the amount is followed by the letters CR, your account is in credit and you can contact us for a refund.

- The monthly payments that you need to make and the date that they need to be made by. If you pay by Direct Debit the amount shown will automatically be taken from your bank account on your chosen date. Any arrears or amounts outstanding from previous years are not included in these instalments and should be paid as previously arranged. You can make your payments online or set up a Direct Debit by going to our Business Rates payment page.