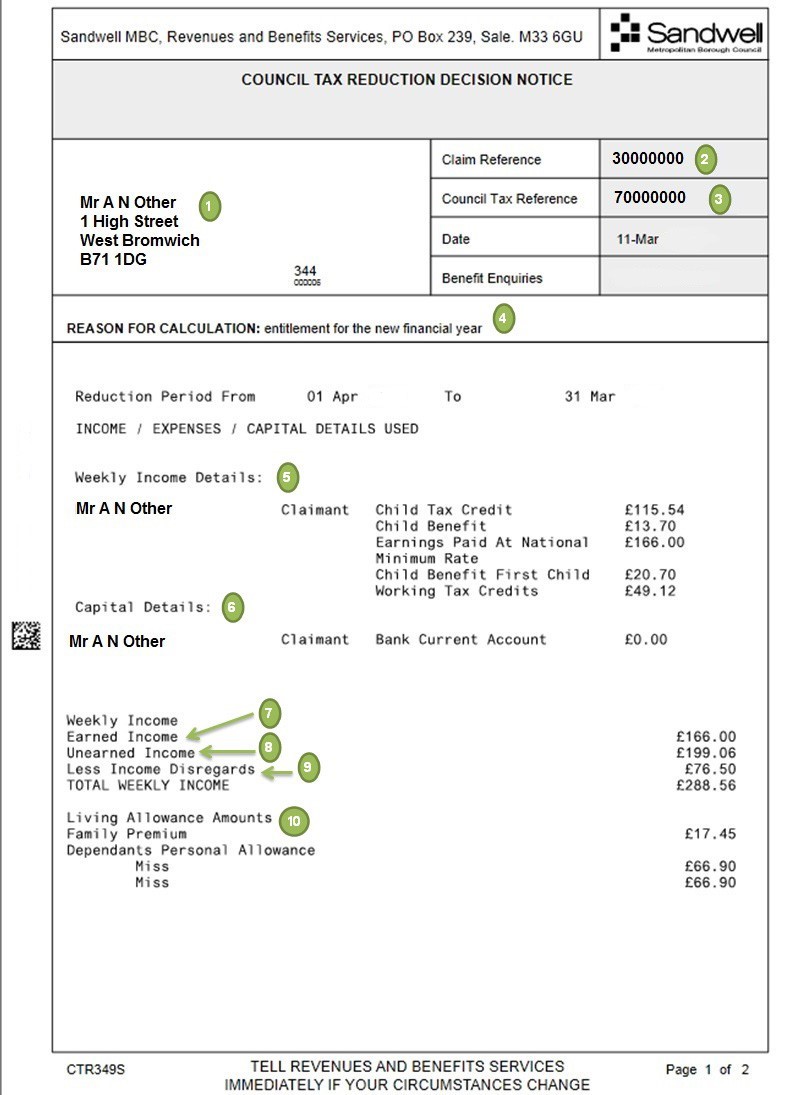

Your Council Tax Reduction award notice can be confusing. There is an example of an award notice below and we have put a key underneath that answers some of the questions that we get asked a lot.

- Name and address of person who has claimed Council Tax Reduction.

- The reference number for your benefit claim. Please quote this number whenever you contact us about your Council Tax Reduction.

- The Council Tax account number for the property. This will change when you move address. Please quote this number whenever you contact us about your Council Tax.

- This is the reason that a calculation has been made on your claim.

- This is a list of the income that we are using to work out your Council Tax Reduction claim. The figure shown is the weekly amount that you receive.

- This is a list of any savings that you have.

- This is any income that you and your partner receive from a job or other work.

- This is any income that you and your partner receive from any benefits or pensions that you have.

- Disregarded income is an amount that is taken off your income under council rules. The remaining amount is then used in the calculation of Council Tax Reduction. If you want to know what rules we work to please read our policy on our Local Council Tax Reduction page.

- The Living Allowance is the amount of money that you and your family need to live on each week. We use the amounts set by the Government for the Applicable Amount used for Housing Benefit.

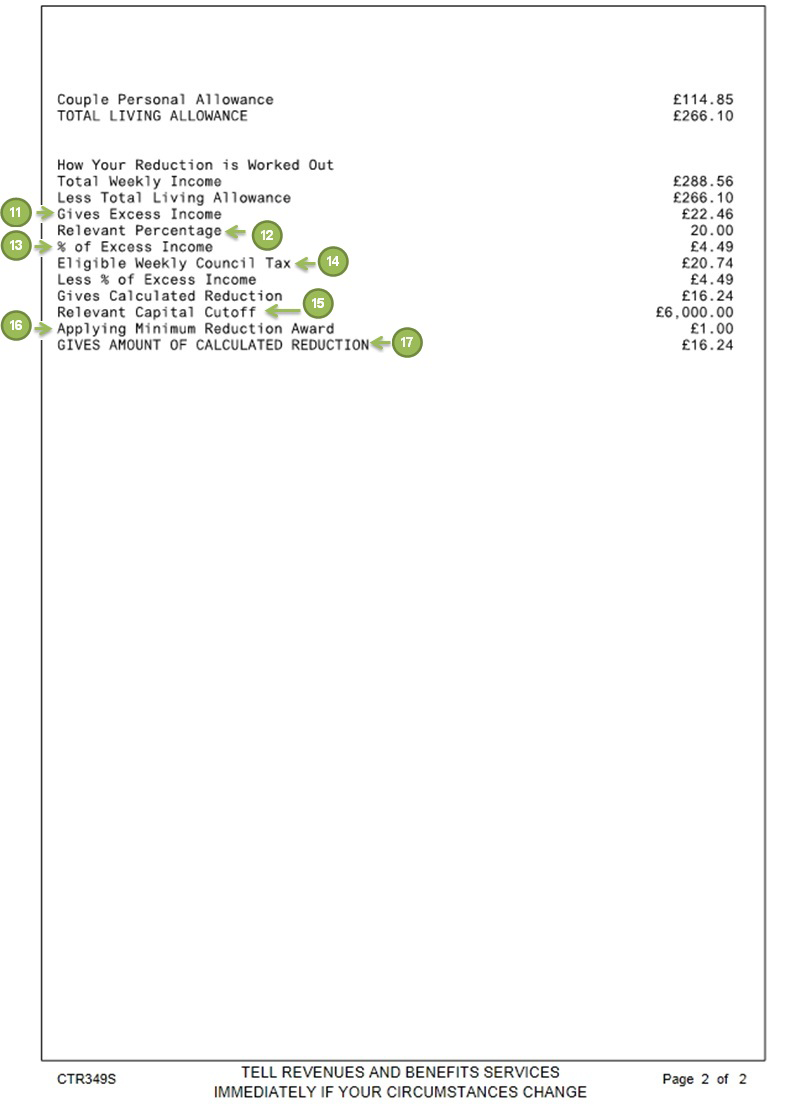

- This is the difference between the amount of income that you receive and the amount that you need to live on. If the figure has a minus in front of it this means that you have less income that you need to live on. If you have less income than you need to live on then you may be able to get more help. Visit the Department for Work and Pensions website to find out more.

- A proportion of your weekly excess income needs to be put towards your Council Tax. In Sandwell this proportion is 20%.

- This is the amount of weekly excess income that you should put towards paying your Council Tax.

- This is the weekly amount of Council Tax that is able to be considered for a reduction.

- This figure is the maximum amount of savings that you can have before you no longer qualify for Council Tax Reduction.

- This is the minimum amount of weekly Council Tax Reduction that you must qualify for in order to receive an award. If you qualify for less than this figure then no payment of Council Tax Reduction will be made.

- This is the weekly amount of Council Tax Reduction that will go towards your Council Tax bill.

If any of the figures that we are using to work out your Council Tax Reduction are incorrect or if your circumstances change please contact us.